What is Merger and acquisition (M&A)?

Mergers and acquisitions (M&A) are transactions in which the ownership of companies, other business organizations, or their operating units are transferred or consolidated with other entities. As an aspect of strategic management, M&A can allow enterprises to grow or downsize, and change the nature of their business or competitive position.

From a legal point of view, a merger is a legal consolidation of two entities into one, whereas an acquisition occurs when one entity takes ownership of another entity's stock, equity interests or assets. From a commercial and economic point of view, both types of transactions generally result in the consolidation of assets and liabilities under one entity, and the distinction between a "merger" and an "acquisition" is less clear.

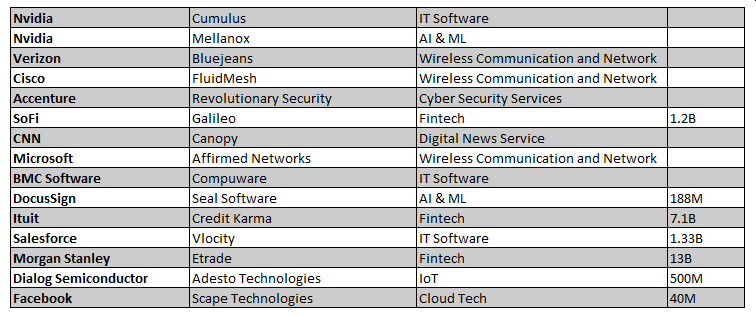

Even during the ongoing pandemic, companies did not hold back to broaden the spectrum of their area and field. The major chunk of the acquisition involves the Technology sector where Wireless Communication and Network, and IT Software comprised of the major portion. Microsoft at the top has already acquired four companies in the first half of 2020 followed by Accenture.

What is the role of Intellectual Property in M&A?

Intellectual property (IP) is property arising from intangible creations of the human intellect. There are many types of intellectual property, and some countries recognize more than others. The most well-known types are copyrights, patents, trademarks, and trade secrets. Now just like any other assets a company may own, IP is one of them and hence, a crucial part of M&A. IP assets are the intangible assets of the company which play an important role in the growth of a company and add up an immense value to the asset portfolio. It is one of the reasons for which IP assets are acquired and companies go for the reconstruction process such as M&A. Benefits of IP in Acquisition or Merger-

Value addition to the firm's portfolio

Acquiring unique capabilities

Transfer of technology

Diversification

Growth

Let’s discuss the importance of conducting IP due diligence during M&A. The need for an IP due diligence is to find any assumptions regarding valuations and where possible, to determine and quantify any related risks. The due diligence report may provide for several types of transactions including company mergers and acquisitions, asset sales, joint ventures, and valuations, among other possibilities. For potential buyers, knowledge concerning the strength of a target's IP assets helps to find any risks associated with the seller's IP portfolio and may determine whether the transaction is beneficial or not. Therefore, unless due diligence is conducted effectively, companies may be exposed to unknown risk factors and liabilities. For sellers, due diligence may improve the marketability of their company and allow them to identify weaknesses and risks in their IP portfolio which might compromise a sale.

Now, the transfer of all IP assets to the buyer needs to be dealt with with equal caution. When IP changes hands, records need to be updated at the relevant registries if the rights are to be properly maintained and enforced. Once the portfolio has been evaluated, consideration needs to be given to updating the ownership of rights and transferring any rights based on agreements to the new owner. It is important to do this in a good time, especially if the company ceases to exist after the transaction and it is no longer possible for the relevant documents to be signed. Changing IP ownership is not always a simple procedure. Each jurisdiction has its pros and cons, requirements, and fees, whether in terms of the documents that need to be supplied or the timeframe in which companies need to act. Translation requirements may also need to be considered.

It is much better if a strategy is in place to manage all of this in advance of an M&A. IP lawyers and trademark attorneys are not always included in discussions from the word go. However, the earlier they are included and can be involved in the planning, risk assessment, and risk mitigation, the better the results will be.

What are the reasons for M&A?

Increasing capabilities: Increased capabilities may come from expanded research and development opportunities or more robust manufacturing operations (or any range of core competencies a company wants to increase). Similarly, companies may want to combine to leverage costly manufacturing operations

Gaining a competitive advantage or larger market share: Companies may decide to merge into order to gain a better distribution or marketing network. A company may want to expand into different markets where a similar company is already operating rather than start from ground zero, and so the company may just merge with the other company.

Broaden the spectrum of products & services: Another reason for merging companies is to complement a current product or service. Two firms may be able to combine their products or services to gain a competitive edge over others in the marketplace.

Cutting expenses: When two companies have similar products or services, combining can create a large opportunity to reduce costs. When companies merge, frequently they have an opportunity to combine locations or reduce operating costs by integrating and streamlining support functions.

Surviving the competition: It’s never easy for a company to willingly give up its identity to another company, but sometimes it is the only option for the company to survive. Several companies used mergers and acquisitions to grow and survive during the global financial crisis from 2008 to 2012. During the financial crisis, many banks merged to deleverage failing balance sheets that otherwise may have put them out of business.

Copperpod's intellectual property audit investigates existence, ownership, and market potential for all patents, trademarks, trade secrets and other intellectual property owned by the seller. Copperpod analyzes existing hardware and software systems and processes owned by the seller to provide you a clear and detailed view of the seller's architecture, growth plans and the investment that such growth will require.

Keywords: due diligence in mergers and acquisitions, mergers and acquisitions, m&a, mergers and acquisitions examples, intellectual property, ipr, intellectual property rights

Comments